Stay Updated with Everything about MDS

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Chilat Doina

July 19, 2025

A competitive analysis framework is just a fancy term for a system you use to gather, organize, and make sense of information about your competitors. Think of it less as a stuffy business school concept and more as your own personal playbook for the market.

It's what helps you move beyond just knowing who your rivals are to truly understanding how they operate and, most importantly, where the gaps are for you to win.

Imagine you're coaching a championship sports team. You’d never send your players onto the field without a detailed game plan for the other team. You'd obsess over their past games, know their star players' every move, and pinpoint weaknesses in their defense.

A competitive analysis framework is that exact tool, but for your e-commerce business.

It gives you a repeatable method, stopping you from getting hopelessly lost in a sea of random data points. Instead of just glancing at a competitor's pricing or their latest Instagram post, a good framework forces you to ask the right questions. It helps you organize the answers in a way that suddenly makes patterns and opportunities jump out at you.

Without a framework, you’re just scouting. With one, you’re building a winning strategy.

Every solid framework, no matter how simple or complex, is built on a few core components. Each piece acts like a different lens, giving you a unique view of the competitive landscape. Getting a handle on these building blocks is the first step to creating a system that gives you real intelligence, not just a pile of facts.

These components are what make sure your analysis is actually useful. For example, knowing a competitor has 20% of the market share is interesting, but not very helpful on its own. A framework pushes you to ask why their share is growing, what product features are driving that growth, and how their marketing is resonating with customers.

A framework turns observation into insight. It’s the difference between watching the game and understanding the strategy behind every play. This structured approach is what separates reactive businesses from proactive market leaders.

Let's break down these essential components. The table below shows how a competitive analysis framework carves up a complex market into smaller, more manageable parts. This is the foundation for all the specific models and metrics we’ll get into later.

Understanding these four pillars is key. They ensure that the time you spend analyzing the competition leads to smart, strategic moves that actually grow your business.

Let's get one thing straight: there’s no single, perfect playbook for analyzing your competition. The best competitive analysis framework is always the one that directly answers your most pressing questions. Different goals simply require different analytical lenses.

Trying to force a one-size-fits-all model onto your business is like a photographer using a single lens for every shot. You’d miss the fine details in a close-up and lose the bigger picture in a panorama. It just doesn't work.

So, how do you choose? It’s all about matching the tool to the task. Are you trying to get a gut check on your company's health versus the market? Or are you aiming to map out the power dynamics of your entire industry? Each question points you toward a different framework.

Let's walk through some of the most effective models so you can pick the one that gives you the clearest picture.

Think of a SWOT analysis as the versatile 50mm lens of the strategy world. It’s the all-purpose tool every business owner should have in their back pocket. What makes it so useful is its balanced perspective—it forces you to look both inward at your own company and outward at the market.

SWOT is a simple acronym for Strengths, Weaknesses, Opportunities, and Threats. It’s beautiful in its simplicity but surprisingly powerful when you dig in.

A SWOT gives you a quick, high-level snapshot of where you stand right now. It's the perfect starting point before you dive into anything more complex.

If SWOT is your trusty standard lens, Porter's Five Forces is your wide-angle. It zooms out from your company to capture a panoramic view of your entire industry—its structure, its rivalries, and its overall potential for profit. Developed by Harvard professor Michael E. Porter, this model helps you understand the hidden currents that shape competition.

This framework is gold when you're thinking about jumping into a new market or trying to figure out why your current one feels like such a battleground. For e-commerce sellers, getting a handle on these forces is especially revealing. You can see how this plays out in a specific ecosystem by checking out guides on how to conduct an Amazon competitor analysis.

The five forces are:

By looking at your market through these five forces, you get a much deeper read on its long-term health and can start building a strategy to defend your turf.

A robust competitive analysis framework is essential for developing effective strategies, including strong brand positioning. Seeing how rivals position themselves can inspire your own approach; check out these Top Brand Positioning Examples for inspiration.

Finally, we have Strategic Group Analysis. This is your telephoto lens. It lets you zoom right in on the clusters of competitors who are your most direct rivals. This model works from a simple truth: not all competitors are created equal. Some are playing the exact same game you are, targeting the same people with similar products and prices.

The framework is pretty straightforward. You plot your competitors on a two-axis map based on a couple of key strategic dimensions. For an e-commerce brand, your axes could be something like "Price Point" (from budget to luxury) and "Product Quality" (from basic to premium).

Mapping your rivals this way helps you do three things very clearly:

This focused view is perfect for fine-tuning your strategy to outmaneuver the competition in your specific corner of the market.

Any competitive analysis framework is just a skeleton. It’s the data you feed it that gives it muscle and makes it move. To make genuinely smart decisions, you have to track the right metrics—the real numbers that pull back the curtain on your competitors' strategies and shine a light on their weaknesses.

Think of it like flying a plane. A pilot isn't staring at every single dial on the dashboard. They're focused on the critical few that show altitude, speed, and direction. For an e-commerce brand, those critical dials fall into four main categories: market position, product strategy, marketing channels, and customer experience.

If you consistently track the numbers in these four areas, you can build a detailed scorecard that shows exactly where you stand against your rivals. This doesn't just tell you who's winning; it tells you how they're doing it.

First things first: you need to know how big of a player your competitor is. This goes way beyond simple sales figures. It’s about their overall influence and how much space they occupy in the market's mind. Two metrics are absolutely essential here: market share and share of voice.

Market share is the classic. It's a straightforward measure of a company’s sales compared to the total market. For example, in the global smartphone arena, Apple held a 21% market share in the first quarter of 2023, just beating out Samsung's 19%. Watching these numbers change over time shows you who's gaining ground and who's slipping.

Share of voice, on the other hand, is all about brand visibility. It answers the question: "How much of the conversation in our industry is about them versus us?" You can get a feel for this by monitoring:

Keep an eye out for a competitor with a small market share but a share of voice that's growing fast. That's a clear signal they're capturing attention, and sales will likely follow.

How a competitor prices and packages their products is like reading their secret playbook. Are they trying to be the cheapest, the best quality, or the one with all the bells and whistles? Figuring this out helps you find your own unique sweet spot.

Start by putting your products side-by-side. A simple feature comparison grid can reveal where you shine and where you're lagging. But don’t just list features—note the benefits they deliver to the customer. That's what really matters.

Next, dig into their pricing.

This intel is gold. It helps you price your own products smartly, so you can compete without starting a race to the bottom. You can position your brand as the premium choice, the budget-friendly option, or the best all-around value.

A competitor’s pricing is a strategic statement. A high price says “we are the best,” while a low price says “we are for everyone.” Understanding that statement is key to crafting your counter-message.

Having a killer product isn't enough. You have to get it in front of the right people. By analyzing where your competitors are finding their customers, you learn where you should be spending your time and money.

Focus your investigation on their main traffic sources. Using tools like Ahrefs or Semrush, you can snoop on their key channels:

This kind of intelligence helps you refine your own marketing. For a deeper dive into building out your own plan, check out these powerful ecommerce marketing strategies. You might uncover an untapped channel they're completely ignoring or spot a weakness in their ad copy you can exploit.

Today, people don't just buy products; they buy experiences. The way a competitor treats its customers can be a massive differentiator. This one is a bit harder to measure with numbers, but it's incredibly important.

You'll need to gather qualitative data by doing some old-fashioned detective work:

A competitor might have a fantastic product, but if their customer experience is clunky and frustrating, they're vulnerable. Finding those friction points gives you a golden opportunity to swoop in and win over their unhappy customers by offering a smoother, more pleasant journey.

Alright, let's get our hands dirty. Moving from theory to action is where the real magic happens. A competitive analysis framework isn't some abstract concept you read about once; it's a practical, living tool you build and use to make smarter decisions.

Building your own framework might sound intimidating, but it really just boils down to a few logical steps. I'll walk you through the entire process. To make it real, we'll use a hypothetical e-commerce startup that sells high-quality, sustainable pet toys. This should make each step tangible, whether you're selling dog beds or designer handbags.

Before you even think about snooping on your competitors, you need to know why you're doing it. What specific question are you trying to answer? Without a clear goal, you'll end up drowning in a sea of useless data. It's a classic case of analysis paralysis, and it's a huge time-waster.

Your goals have to be specific and tied to a business decision. For our pet toy startup, a great goal would be: "Identify gaps in the market for eco-friendly cat toys to guide our next product launch." That’s worlds better than a vague goal like, "See what other pet brands are doing."

Once you have your goal, define your scope. You can't analyze every single brand out there. Keep it manageable and focused by zeroing in on your top 3-5 competitors. This will keep your insights sharp and the project from spiraling out of control.

Competitors come in a few different flavors, and you need to know who's who to get a complete picture of the market. Think of them in three categories.

With your goals set and your rivals identified, it's time to play detective. This phase is all about systematically collecting data across several key areas. A solid framework is a must-have when you're creating a robust digital marketing plan because it gives your strategy a foundation in reality.

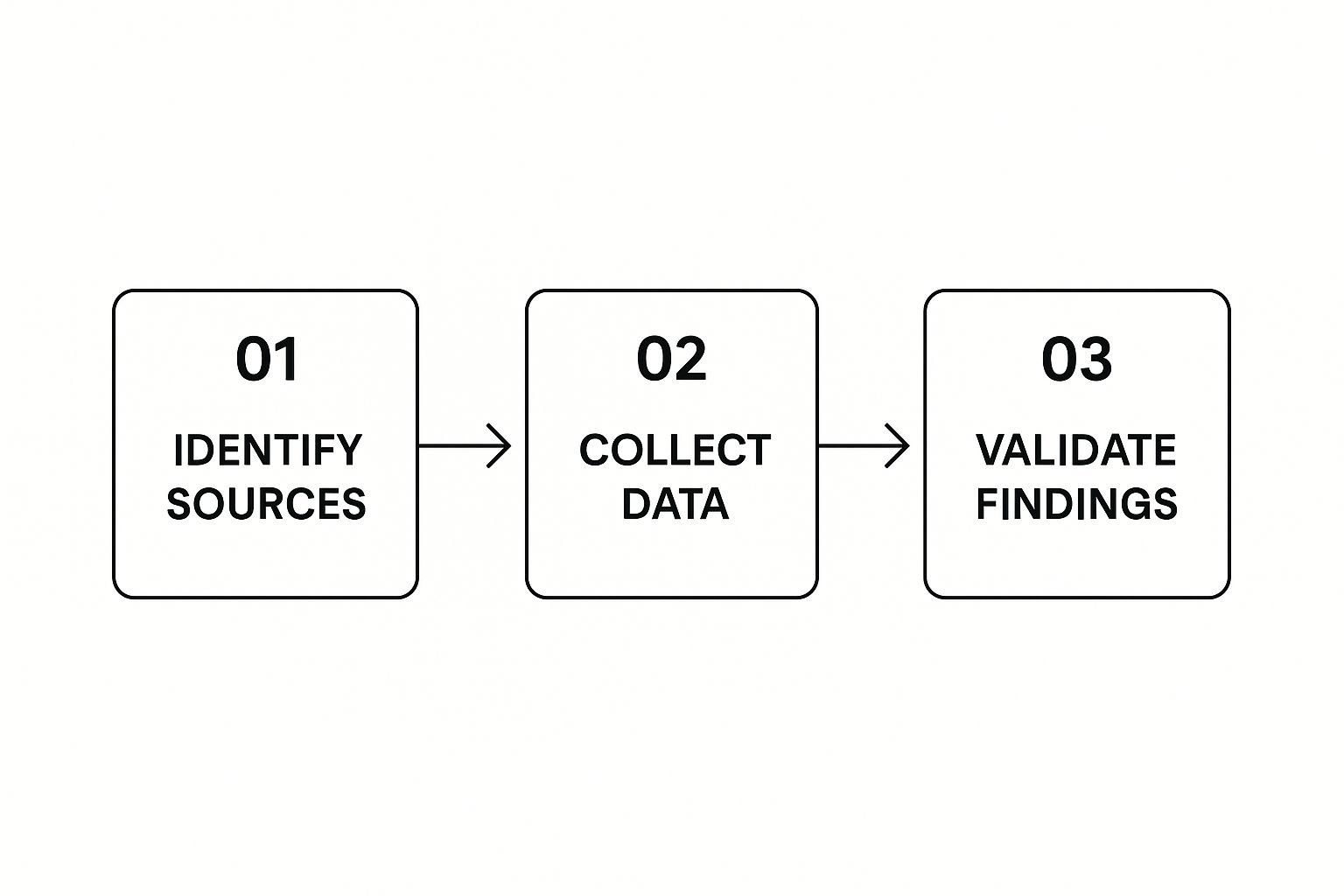

The process of gathering intelligence is a simple, repeatable flow. You figure out where to look, collect the data, and then double-check its accuracy.

This visual really drives home the importance of a structured approach. It's a cycle, not a one-and-done task.

To keep things organized, focus your collection efforts on four main buckets:

To make this data collection easier, you'll want some tools in your corner. Different tools are good for different things, from scraping website data to monitoring social media chatter.

Here's a quick breakdown of the types of tools you can use to gather intelligence on your competitors. Each category serves a different purpose, so combining them often gives you the most complete picture.

Using a mix of these tools allows you to go beyond just what a competitor says about themselves and see what they're actually doing and how customers are responding.

Raw data is just a jumbled mess of facts. The next step is to organize it in a way that lets you see the patterns. Honestly, a simple spreadsheet is often the best tool for the job.

Create columns for each competitor and rows for every metric you’re tracking—price, key features, Instagram followers, primary marketing message, and so on.

As you start filling it out, the story will begin to take shape. You might notice that all your direct competitors are completely ignoring TikTok. Or maybe you'll see a recurring theme in customer reviews complaining about the low durability of a rival’s "indestructible" toys. That’s a gap.

Insight: Analysis isn't about listing facts; it's about connecting the dots. The goal is to find the story the data is telling you about your competitors' strategies and the market's unmet needs.

This is where having a framework really pays off. It transforms that chaotic pile of data into a clear map of your competitive landscape, showing you exactly where the dangers and opportunities lie.

This is the final and most crucial step. An insight is totally useless if it just sits in a spreadsheet. Each key finding you uncover must lead to a specific, strategic decision for your business.

Let's go back to our sustainable pet toy brand one last time.

This is a perfect example of how your framework informs your bigger picture. Initiatives like these become core components when you create a comprehensive ecommerce business plan.

By following these five steps, you're not just creating a one-off report. You're building a living, breathing strategic tool that keeps your business agile, informed, and always one step ahead of the competition.

Even with the best competitive analysis framework, it's surprisingly easy to get things wrong. A flawed approach doesn't just waste your time; it can point you toward bad strategic decisions that actively harm your business. Knowing the common tripwires is the first step to keeping your analysis sharp, relevant, and genuinely useful.

One of the biggest traps I see founders fall into is focusing only on their direct, most obvious rivals. Sure, you have to watch the companies selling similar products. But ignoring what's happening on the periphery is a massive risk. True disruption almost never comes from where you expect it.

This kind of tunnel vision can blindside you to emerging threats and clever business models that could completely reshape your industry. A real analysis has to look at the indirect and up-and-coming competitors to get the whole story.

Ever spent weeks pulling data, making gorgeous charts, and compiling a huge report... only for it to sit in a folder, untouched? That's analysis paralysis. It's the dangerous habit of letting endless data collection take the place of making a decision.

The whole point of a competitive analysis framework isn't to create a perfect encyclopedia of your market. Its job is to find just enough insight to help you make the next right move. When gathering data becomes the end goal, your framework has failed you.

To sidestep this, set clear, action-oriented goals right from the start. Ask yourself, "What specific decision will this information help me make?" That simple question forces you to focus on outcomes, not just on piling up more information.

The most effective analysis is one that leads to a decision. Don't let the hunt for more data become an excuse to delay making a choice. Action, even with imperfect information, will always beat inaction.

Another critical mistake is treating your analysis like a task you can check off a list. The market isn't static; it's a living, breathing thing. Your competitors are launching new products, changing their marketing, and adjusting prices constantly.

A report that was spot-on three months ago might be dangerously outdated today. For your framework to be a real strategic tool, it needs to be a continuous process, not a one-off project.

Think of it like checking the weather. You don't just look at the forecast once in January and assume you're set for the season. You check it daily to decide what to wear. Your competitive analysis needs that same regular attention to guide your daily and quarterly decisions.

It’s easy to get obsessed with the big, established players in your industry—the brands with huge market share and name recognition. But the biggest threats to your future often start as small, scrappy newcomers who are breaking all the rules.

These disruptors often compete on totally different terms:

For example, a small e-commerce brand that masters TikTok marketing can build a devoted community and steal market share before larger, slower competitors even realize what's happening. Regularly scanning for these upstarts and figuring out what makes them tick is non-negotiable for long-term survival. By recognizing these common pitfalls, you can make sure your competitive analysis stays the dynamic, agile, and effective tool it's meant to be.

When you start digging into competitive analysis, a bunch of questions usually pop up. How often do you actually need to do this? Is this just another name for market research? And maybe most importantly, how do you get this information without crossing any ethical lines?

Getting solid answers here is key. It’s what turns a one-off project into a sustainable, effective process for your business. Let's tackle some of the most common questions so you can move forward with total confidence.

There’s no magic number here—the right frequency really boils down to how fast your industry moves.

If you’re in a fast-paced space like consumer electronics or e-commerce fashion, you should be doing a quarterly review, minimum. Trends, players, and marketing tactics shift so fast that checking in just once a year would leave you playing catch-up.

For more stable industries, maybe you sell niche industrial parts, a bi-annual or annual review could be totally fine. The competitive chess board just doesn't change as quickly in those areas.

Think of your competitive analysis as a living, breathing document—not a report you write once and file away. A major market event should always trigger an immediate update, no matter your schedule.

Speaking of major events, you need to be ready to spring into action when something big happens. Here are the main triggers for an on-the-spot update:

By setting a regular cadence but staying ready to react, you make sure your analysis is always a powerful tool, not an outdated snapshot.

Great question. Getting this distinction right is crucial. The easiest way to think about it is with a painting analogy.

A competitor analysis is like a hyper-detailed portrait. You're focusing intensely on a few specific subjects: your rivals. You obsess over every little detail of their products, pricing, marketing, and strategy to understand them inside and out. The whole point is to find their strengths and, more importantly, their weaknesses.

A market analysis is more like a sweeping landscape painting. It captures the entire industry in one broad view. Your competitors are in the picture, of course, but it also examines:

In short, a market analysis tells you where to play, and a competitor analysis tells you how to win against the other players already there. You absolutely need both. One gives you the map; the other gives you the playbook.

Gathering intelligence is the name of the game, but doing it ethically is non-negotiable. Getting this wrong can wreck your reputation and land you in legal hot water. The good news? There’s a mountain of valuable information available through completely public and legitimate channels.

Ethical intelligence gathering is all about using sources that are out in the open for anyone to see. Your entire competitive analysis framework must be built on this foundation.

Here are some excellent, totally ethical sources:

What should you avoid at all costs? Unethical tactics like misrepresenting yourself (posing as a customer just to grill a sales rep) or trying to get a competitor's current or former employees to violate an NDA. The goal is to out-think and out-strategize your competition, not to cheat your way to the top.

At Million Dollar Sellers, our members operate at the highest level, where sharp strategy and ethical execution are paramount. We foster a community where top e-commerce founders share the very insights that keep them ahead of the competition, helping you scale smarter and faster. Learn more about the power of our exclusive network.

Join the Ecom Entrepreneur Community for Vetted 7-9 Figure Ecommerce Founders

Learn MoreYou may also like:

Learn more about our special events!

Check Events