Stay Updated with Everything about MDS

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Chilat Doina

July 23, 2025

In a world of ever-climbing ad costs, your most reliable path to real, sustainable growth isn't just finding new customers. It's about maximizing the value of the ones you already have. This is where customer lifetime value (CLV) comes in. It represents the total revenue you can reasonably expect from a single customer over their entire relationship with your brand.

Thinking in terms of CLV shifts your focus from one-off sales to building profitable, long-term relationships that truly fuel your bottom line.

So many e-commerce brands get stuck in the "acquisition trap." They pour endless cash into ads to attract new buyers, all while their existing customers quietly churn. I've seen it time and time again. It’s like trying to fill a bucket with a massive hole in it—sure, water is coming in, but you're losing it just as fast. Your sales numbers might look busy, but real growth stays frustratingly flat.

When you start focusing on increasing customer lifetime value, you fundamentally change that dynamic. It’s a mindset shift away from short-term transactions and toward building genuine, lasting relationships. The impact on your business's health and profitability is profound.

When you don’t pay attention to CLV, you're not just missing out on some repeat purchases. You're exposing your business to some serious risks. For instance, any brand that relies solely on acquisition is incredibly vulnerable to changes in advertising costs. The moment Facebook or Google decides to hike their ad prices, your entire growth engine can sputter and die.

A low CLV is also a massive red flag for your customer experience. If people aren't coming back, it's a clear signal that something—your product, your shipping, your service—isn't hitting the mark. This "leaky bucket" doesn't just drain revenue; it slowly poisons your brand's reputation through bad reviews and negative word-of-mouth.

The link between keeping customers and making more money is crystal clear. Research has shown that even a 5% bump in customer retention can boost profits anywhere from 25% to a staggering 95%. You can dig deeper into these customer lifetime value statistics on tipsonblogging.com.

Once you adopt a CLV-driven approach, you start building a much more resilient and predictable business. Instead of constantly hunting for the next new lead, you cultivate a loyal base of customers who provide a stable, recurring stream of revenue.

This focus unlocks several key advantages:

To truly integrate CLV into your operations, you need to think about it as the foundation of your retention marketing. The table below breaks down the core pillars of a strategy designed to do just that.

Ultimately, CLV is more than just a number on a dashboard. It’s a strategic lens for viewing your entire business. It guides your decisions in marketing, product development, and customer service, all pointing toward a single, powerful goal: building a business that doesn't just survive, but thrives on loyalty.

Before you can even think about improving your customer lifetime value, you've got to know where you stand today. What’s your current CLV? Answering that question is the first real step in turning a vague business goal into a concrete plan of attack. Without that baseline, you're just flying blind, hoping your retention efforts are working but with no real way to prove it.

Don't worry, this isn't some data-scientist-level task that requires a PhD. You can get started with a simple, historical model that gives you actionable insights right away. Down the road, as you grow, you can explore more complex predictive models for even sharper accuracy.

Let's walk through how to get your number.

The most direct path to calculating your historical CLV is by pulling together three key metrics you already have sitting in your e-commerce platform. This formula gives you a clear snapshot of what an average customer has been worth to your business so far.

Here’s what you need to find:

Once you have those three numbers, the math is straightforward:

CLV = Average Purchase Value (APV) x Purchase Frequency (PF) x Average Customer Lifespan (ACL)

Let's put this into a real-world context. Imagine you run a coffee subscription service. If your APV is $50, your average customer places 6 orders a year (PF), and they typically stick around for 3 years (ACL), your CLV is a cool $900. Suddenly, you know that every new subscriber you bring in is worth an average of $900 in revenue. That's a powerful number.

The historical model is fantastic for getting your feet wet. Its only real limitation is that it’s based on past behavior. Predictive CLV models are the next level up, using more granular data and even machine learning to forecast future customer value.

While predictive models are the gold standard for many, don't let them intimidate you at the start. The most important thing is to begin measuring something. You can always upgrade your methods later on.

Calculating your CLV is only the first part of the equation. The magic happens when you use that number to make smarter business decisions. It immediately helps you figure out a reasonable Customer Acquisition Cost (CAC) and, crucially, points you toward your most valuable customer segments.

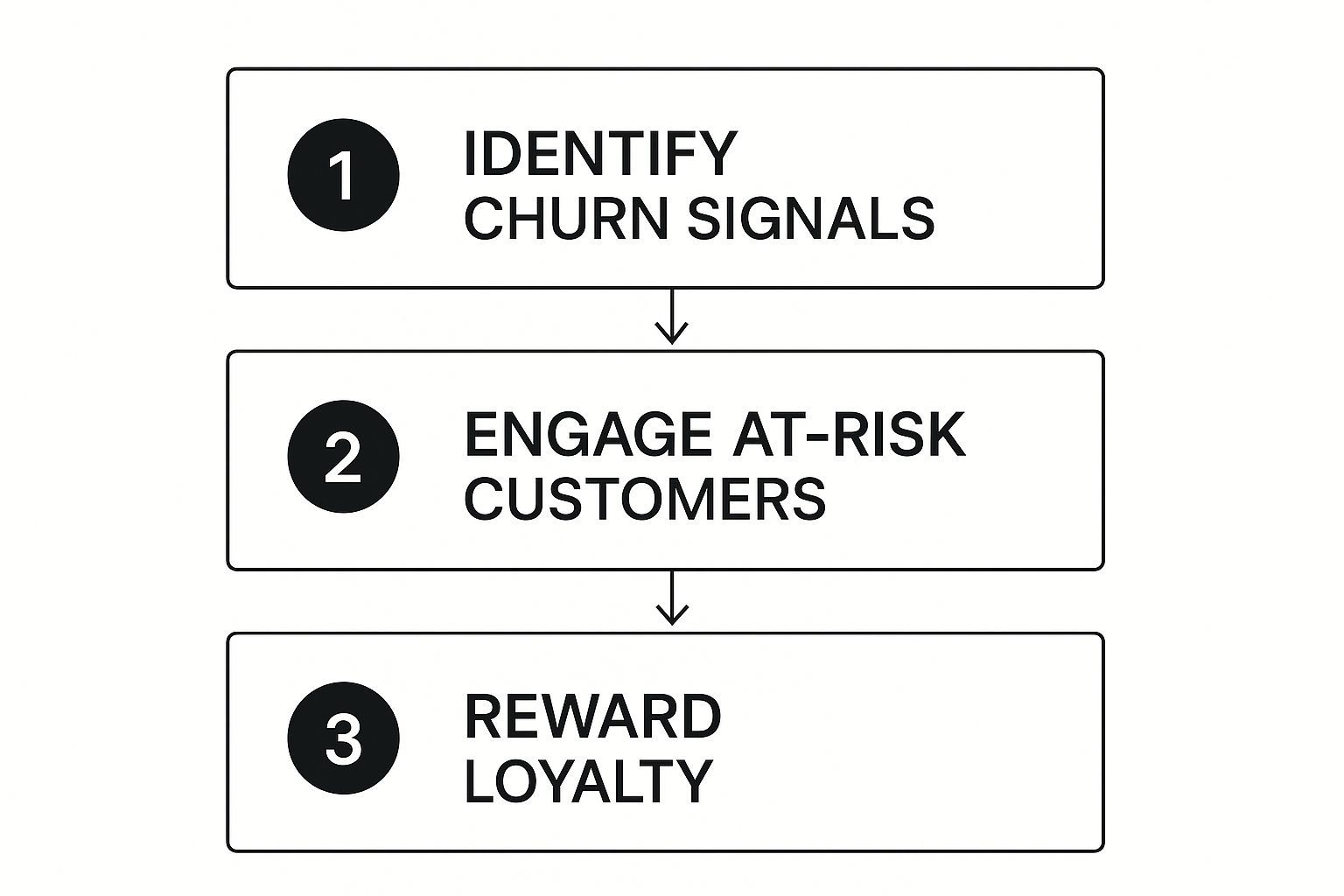

This infographic breaks down a simple but effective flow for using CLV insights to cut down on churn and build up loyalty.

As you can see, it all starts with identifying at-risk customers so you can engage them proactively, which in turn helps you reward the loyalty you’ve worked so hard to build.

For example, a seasonal apparel store might see that a high-value customer hasn't made their usual pre-summer purchase. That's a huge churn signal. It should immediately trigger a personalized email or an SMS campaign to bring them back.

Or, if you run a subscription box, a churn signal could be a customer who starts skipping months more frequently. The right move isn’t to just let them fade away. It’s to engage them with a quick survey or a special offer to better understand what’s changed.

Once you calculate your CLV, you stop seeing customers as one-off transactions and start seeing them as long-term relationships worth investing in.

Let’s be honest: generic, one-size-fits-all marketing just doesn't cut it anymore. Your customers are bombarded with ads, and the only way to stand out is to make them feel seen. Personalization is your single most powerful tool for increasing customer lifetime value because it proves you’re paying attention.

This isn’t about just plugging a {{first_name}} tag into your email subject line. Real personalization runs much deeper. It means digging into your customer data—their purchase history, browsing habits, even quiz answers—to create an experience that feels less like a sales pitch and more like a genuinely helpful conversation.

Think about an online bookstore that knows you’re a sucker for historical fiction. When a new book from your favorite author drops, you get an alert. That's the kind of service that builds die-hard fans and keeps people coming back for more.

Your customer's purchase history is a treasure trove. It's a direct line into what they like, what they need, and what they’re likely to buy next. Putting this data to work in your product recommendations is one of the fastest ways to give your CLV a serious boost.

It's not just a hunch, either. A Yotpo survey found that 53.9% of customers define personalization as getting recommendations based on past purchases. This has gone from a "nice-to-have" to a core expectation.

Here’s how to put that into action:

For a pet supply store, this could mean seeing a customer buys the same dog food every five weeks. An automated email in week four with a one-click reorder link and a suggestion for a new chew toy is a brilliant, low-effort way to add value and lock in another sale.

Why show every visitor the exact same homepage? That’s prime real estate you’re wasting. With dynamic content, you can tailor your site to different customer segments, making it instantly more relevant and engaging.

A personalized website is like giving every visitor their own personal shopper. It anticipates their needs and guides them straight to what they’ll love, driving up conversions and encouraging them to return.

You could use a customer's location to highlight winter coats for shoppers in colder climates. Or, if a logged-in customer lands on your homepage, greet them by name and immediately show them a "Recommended for You" section based on their recent activity.

A few powerful ways to make your site dynamic:

This level of customization makes your store feel intuitive and thoughtful, which is a huge driver of long-term loyalty.

Blasting your entire email list with the same generic offer is the fastest way to get ignored—or worse, marked as spam. Segmenting your audience lets you send messages that actually resonate, which naturally leads to better engagement and a higher CLV.

Just look at the difference between a generic and a segmented campaign:

You can slice your audience into countless segments. If you’re just starting, focus on these high-impact groups:

By tailoring your messaging, you show customers you see them as individuals, not just numbers on a spreadsheet. That recognition is the foundation for building real, lasting loyalty.

Once someone clicks "buy" for the first time, your job isn't over. In fact, the real work is just getting started. This is the moment you pivot from simply acquiring a sale to actually building a relationship—and that’s the secret to blowing your customer lifetime value numbers out of the water.

A solid retention program is so much more than a flimsy points system. It’s about creating an experience that makes people feel seen, appreciated, and genuinely connected to your brand. It's how you turn a one-time buyer into a loyal fan for life.

Let's be honest: a simple "spend more, get points" system is table stakes these days. It’s a start, but it won't create the kind of fierce loyalty that drives real growth. Your program needs to feel less like a transaction and more like a relationship.

This is where a tiered loyalty structure comes in. Think about it: a customer joins the "Bronze" tier right after their first purchase, maybe unlocking a small welcome discount. After they've spent a bit more, they level up to "Silver" and get free shipping.

But the "Gold" or "VIP" tier? That’s where the magic really happens. These are your best customers, and the perks should make them feel like it.

Here are a few ideas that work wonders for top-tier members:

This approach gamifies the experience and gives customers a clear reason to stick with you instead of shopping around.

People are wired for belonging. Creating a genuine community around your brand is one of the most powerful retention tools you have because it taps into that fundamental human need. I'm not just talking about posting on Instagram—I mean creating a dedicated space where your best customers can connect with you and, just as importantly, with each other.

Imagine a cosmetics brand creating a private Facebook group just for its top-tier members. Inside, they could share makeup tutorials, ask for direct feedback on new product ideas, and even host live Q&As with the founders.

This does two incredible things:

That feeling of being an insider builds loyalty in a way a 10% discount never could.

One of the most important metrics we track in e-commerce is the average monetary value a customer brings in over their entire relationship with a brand. Across the industry, the average CLV is somewhere between $100 and $300, though this can vary wildly. A great retention program directly pumps up this number by driving more frequent, higher-value purchases. For more on this, check out these CLV statistics in e-commerce on amraandelma.com.

Look, not every customer is going to stick around forever. It happens. But a smart, targeted win-back campaign can bring a valuable customer back into the fold before they're gone for good. The key is to be strategic, not desperate.

First things first, you need to define what "lapsed" actually means for your business. If you sell coffee, a customer might be considered lapsed after 90 days. If you sell mattresses, it could be three years.

Once you’ve identified these quiet customers, don't just blast them with a generic "We miss you!" email. Get specific by segmenting them based on their past buying habits.

A well-executed win-back campaign isn't just about reclaiming lost sales. It’s a golden opportunity to figure out why customers are leaving in the first place, which is a vital part of any serious strategy to improve your e-commerce customer retention.

For any brand selling consumable or replenishable goods, a subscription model is an absolute game-changer for CLV. It automates repeat business, creating a wonderfully predictable revenue stream. You’re no longer hoping for another sale; you’re providing an ongoing service.

Take a pet food brand, for example. Instead of crossing their fingers that a customer remembers to reorder, they can offer a subscription that delivers a fresh bag of food every 30 days. It's the ultimate convenience for the customer and guaranteed monthly revenue for the business.

To make your subscription offer a no-brainer, bake in some attractive perks:

By locking in that repeat business, subscriptions dramatically increase both the monetary value and the lifespan of every customer you bring in. It's a cornerstone of any truly powerful retention program.

Boosting the value of every sale is one of the most direct ways to pump up your Customer Lifetime Value. But there’s a fine line. These tactics need to feel genuinely helpful, not like a pushy, aggressive cash grab.

When you get it right, upselling and cross-selling do more than just lift your Average Order Value (AOV). They make the customer’s experience better by helping them discover exactly what they need—sometimes before they even realize it themselves.

Knowing the difference between the two is crucial. Think of it like a classic fast-food order. The cashier asking, “Would you like to make that a large?” is a classic upsell. But when they ask, “Want some fries with that?”—that’s a cross-sell. One enhances the original item, the other complements it.

Upselling is all about guiding a customer toward a better, more premium version of the product they're already eyeing. The goal is to deliver more value to them while, naturally, increasing the transaction value for you. This works best when the customer is already deep in the buying funnel and has high intent.

Imagine someone adds a standard drone to their cart. This is your cue. A pop-up could appear, showcasing the "pro" version.

This upgraded model might offer:

The secret is to frame the upsell as a better solution, not just a more expensive one. You’re showing them how a small step up in price unlocks a huge leap in performance and satisfaction.

For many SaaS companies, an incredible 70-95% of revenue comes from upselling, with the initial sale making up only 5-30%. While this is from the software world, the lesson is universal for e-commerce: your biggest wins often happen after that first purchase.

This approach is a powerhouse for increasing customer lifetime value because it directly inflates your AOV. You can dive deeper into this and other revenue-boosting tactics in our complete guide on how to increase e-commerce sales.

Cross-selling, on the other hand, is about recommending products that perfectly complement what the customer is already buying. It’s less about upgrading and more about completing the picture. You’re anticipating their next move and offering a convenient solution right then and there.

Think about a customer buying a new tablet. Suggesting a protective case and a screen protector isn't just a sales tactic; it’s a genuinely helpful recommendation. Or a coffee subscription service that offers a high-quality grinder at a discount with the first bag of beans. These additions make the main product immediately more useful.

Here’s how to make your cross-sells feel seamless and smart:

Ultimately, the best cross-sells feel like a concierge service. You're not just trying to sell more stuff; you're helping your customer get the absolute most out of their purchase. That's how you build real trust and keep them coming back.

When you start digging into CLV, a lot of practical questions bubble up. It's one thing to understand the theory, but another to know what to expect when you're in the trenches.

Let’s tackle some of the most common questions I hear from e-commerce founders so you can move forward with confidence.

This is always the first question, and the honest answer is: it depends. The timeline for seeing a real jump in your CLV is tied directly to the strategies you're putting in place.

Some tactics give you a near-instant dopamine hit. If you optimize an upsell flow at checkout, for instance, you can see your Average Order Value (AOV) tick up in just a few weeks. It's a quick win.

But the real, foundational work takes more patience.

If you’re running a smaller operation with a lean team, forget the complex, bells-and-whistles software for a minute. The single most effective strategy is almost always exceptional, proactive customer service combined with some smart email personalization.

This combo delivers the highest return for the lowest initial cost. Period.

A big, multi-tiered loyalty program sounds great, but a small team can create a massive impact just by being human. Think about personally reaching out after a purchase, resolving problems with lightning speed and genuine empathy, and sending emails that show you were actually paying attention to what they bought. That's how you build a rock-solid foundation of trust.

This focus on relationships is what drives repeat business and creates the kind of positive word-of-mouth that money can't buy. It's the perfect low-cost, high-impact starting point for any brand that's serious about CLV.

Absolutely. You don't need a massive war chest to make this happen. In fact, some of the most powerful CLV-boosting tactics are either low-cost or completely free.

A tight budget just forces you to be more creative and focus on the fundamentals. It's about working smarter with the customer relationships and data you already have, not just throwing cash at new acquisition channels.

Here are some effective, budget-friendly strategies:

These moves strengthen the customer bond without a huge ad spend. In fact, doubling down on retention is one of the smartest ways to reduce your overall customer acquisition cost in the long run.

Ready to join a community of elite e-commerce founders who have mastered these strategies and more? The Million Dollar Sellers network provides the peer insights and proven playbooks you need to scale smarter. Apply for membership today.

Join the Ecom Entrepreneur Community for Vetted 7-9 Figure Ecommerce Founders

Learn MoreYou may also like:

Learn more about our special events!

Check Events