Stay Updated with Everything about MDS

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Chilat Doina

December 25, 2025

Calculating your true landed cost is simple enough on the surface: you just add up the product price, shipping fees, customs duties, insurance, and overhead costs. But that simple calculation is one of the most powerful things you can do for your business. This final number shows you what it actually costs to get a product from the factory floor into your warehouse, and it's almost always a lot higher than the price on your supplier's invoice.

Have you ever looked at your P&L and felt completely baffled? Your sales are climbing, your ad spend seems reasonable, but your profits are mysteriously shrinking. You start digging into platform fees and marketing costs, but the numbers just don't add up.

If that sounds painfully familiar, you're not alone. This frustrating scenario almost always points to one hidden culprit: all the little import fees and freight charges that were never factored into your pricing strategy from day one.

The price you pay a supplier is just the beginning of a product's journey—and its cost. Relying on that single number is a surefire way to kill your margins without even realizing what’s happening. This is an especially critical blind spot for e-commerce businesses that need to stay competitive while protecting their bottom line.

The key to unlocking real, sustainable profitability is getting a handle on your total landed cost. This isn't just some tedious accounting task; it’s your most powerful strategic tool for making smart business decisions.

The basic formula gives you a clear roadmap to follow:

Product + Shipping + Customs + Risk + Overhead = Landed Cost

Each piece of that equation is a real, hard cost that hits your bank account. Ignoring even one of them can create huge financial blind spots that leave you vulnerable.

For instance, many sellers are shocked when they realize these "invisible" costs routinely inflate a product's true unit cost by 20–40% compared to what they paid the factory. A product that looks like a winner on paper can quickly become a loss-leader once all the associated expenses are tallied up.

Think about it: a product with a $10 supplier cost can easily become a $13 reality after adding $1.50 for freight, $0.75 in duties, $0.30 for insurance, and $0.45 in overhead. That's a 30% increase that comes directly out of your gross margin unless you price for it.

To help you get started, here's a quick breakdown of the core components you absolutely need to track.

Cost ComponentDescriptionExampleProduct CostThe price you pay the supplier for the goods.$10,000 for 1,000 units of a product.Shipping & FreightThe cost to transport goods from the factory to your warehouse.$1,500 for ocean freight from China to the US.Customs, Duties & TaxesFees charged by the government to import your products.7.5% duty on the commercial invoice value.Risk & InsuranceCosts to protect your goods against loss or damage during transit.$300 for a cargo insurance policy.Overhead & HandlingFees for payment processing, brokerage, port fees, and quality control.$450 in customs brokerage and currency conversion fees.

These five elements form the foundation of your landed cost calculation. Once you start tracking them, you'll have a much clearer picture of your actual costs.

Knowing your landed cost doesn’t just clean up your accounting—it fundamentally transforms how you run your business. It’s about gaining clarity and control. When you have a firm grasp of your real costs, you can finally:

Ultimately, mastering your landed cost is the difference between flying blind and being in the driver's seat. It moves you from a reactive position, where you're constantly surprised by razor-thin margins, to a proactive one where every decision is backed by a complete financial picture.

Moving past the basic formula means getting your hands dirty with the individual moving parts of your total landed cost. Each one has its own quirks and potential traps. Getting these details right is the difference between a ballpark guess and a number you can actually build a profitable pricing strategy on.

Let's dissect each element one by one. I'll give you the kind of practical advice that helps you build a truly accurate cost model from the ground up.

At first glance, your product cost seems simple—it's the price on the supplier's invoice, right? Not so fast. This is where you make your first big strategic decision, and it all comes down to Incoterms. These are the international commercial terms that define the exact moment when responsibility (and all the costs that come with it) transfers from your supplier to you.

The two you'll run into most often as an e-commerce seller are EXW (Ex Works) and FOB (Free On Board).

Choosing FOB over EXW can save you a massive headache and the often-overlooked expense of managing local transport in a foreign country. For a deeper dive into this initial expense, our guide on how to calculate product costs can provide further clarity.

Shipping is often the biggest and most unpredictable variable in your landed cost calculation. It's a confusing world of surcharges and hidden fees that can catch even seasoned importers off guard. Your main choice here is how you'll move your stuff.

But don't just look at the base rate. Be ready for a laundry list of accessorial charges. These can include fuel surcharges (which bounce around with oil prices), peak season surcharges, and a variety of port handling fees. Always, always ask your freight forwarder for a fully itemized quote so you can see exactly what you’re paying for.

Pro Tip: Don't just look at the freight quote; analyze it. A suspiciously low base rate is often padded with insane surcharges. A good freight forwarder is transparent about these costs from the start, which helps you dodge nasty surprises on the final bill.

This is where a lot of sellers really get tripped up. Customs duties are just taxes on imported goods, and the amount you owe is all decided by your product's Harmonized System (HS) code. It's a universal classification system that tells customs what the duty rate is for pretty much every product on the planet.

Using the wrong HS code is a huge and costly mistake. If customs decides you've misclassified an item—even if it was an honest mistake—you could be looking at big fines, your shipment getting stuck for weeks, and a bill for back-payments. A simple classification error can easily swing a duty rate by 5-25%.

The best way to avoid this mess is to work with a customs broker to get your products classified correctly before your first shipment ever leaves the port. You can also do some homework yourself using government tariff databases. Getting this right isn't optional; it's fundamental to your cost planning. Plus, accurately nailing down your landed cost is crucial for knowing how to calculate Cost of Goods Sold, a key metric for your business's health.

Think of cargo insurance as a small expense that protects you from a catastrophic loss. Sure, carriers offer some limited liability, but it almost never covers the full commercial value of your inventory. Skipping proper insurance is a gamble you simply can't afford to take.

Just imagine your $50,000 shipment of electronics ends up at the bottom of the ocean. Without insurance, that entire investment—the product cost, the shipping, everything—is just gone. With a proper policy, you get that money back and keep your business afloat.

The final bucket of costs is filled with all the little miscellaneous fees that add up surprisingly fast. These are the expenses that so many sellers forget to factor in, which completely skews their per-unit cost.

Here are the key fees to watch out for:

These "small" costs can easily tack on another 3-5% to your total landed cost. Tracking them meticulously ensures your final number is based on reality, not just wishful thinking.

This is where the pros separate themselves from the amateurs. Calculating the landed cost for a shipment with just one product is simple enough. But what happens when you have a 40-foot container packed with 15 different SKUs?

You can't just divide the total freight and customs fees by the number of units. That would be a disaster for your profitability analysis.

The real challenge is figuring out how to fairly spread those big, shared costs across a mix of different products. You might have small, expensive electronics sharing space with bulky, cheap accessories. Picking the wrong allocation method can completely distort your per-unit costs, leading to terrible pricing and inventory decisions down the road.

You have a few solid methods to choose from when you need to calculate landed cost at the SKU level. None of them are inherently "right" or "wrong," but one will almost certainly be a better fit for your specific product mix. The goal is to pick the method that most accurately reflects the commercial reality of your shipment.

Here are the four main ways to slice it:

Getting this allocation right is crucial, as it directly impacts your SKU-level profitability and how you manage your stock. For a comprehensive overview of how this fits into your larger operational picture, explore some of the best inventory management software for small business, as many platforms can help automate these calculations.

Let's run through a quick scenario to see why this matters so much. Imagine your container has two products:

The total shared freight and customs fees for this shipment come to $5,000.

If you allocate by quantity, each of the 2,000 units gets an equal $2.50 share of the costs. This makes your cheap phone cases seem much more expensive to import than they really are, while your premium electronics look artificially profitable. Bad news for your pricing strategy.

Now, let's try allocating by commercial value. SKU A represents 80% of the shipment's value, so it gets 80% of the costs ($4,000, or $4.00 per unit). SKU B, at 20% of the value, gets the remaining 20% ($1,000, or $1.00 per unit). This is a much more accurate reflection of reality.

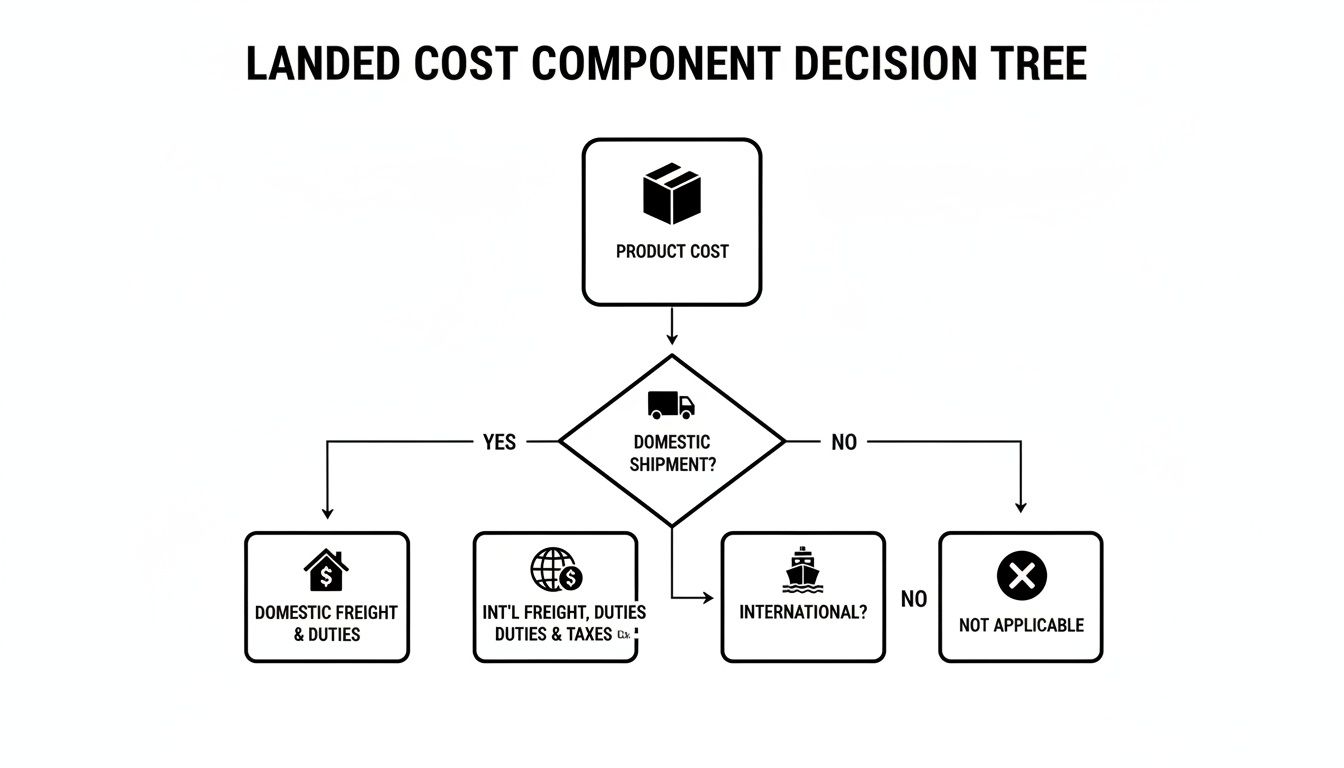

This decision tree infographic helps visualize how different shipment characteristics can guide you toward the right cost components to consider.

As you can see, the flowchart clearly separates the cost pathways for domestic versus international shipments, highlighting the added complexity of customs and duties for imported goods.

The difference between these methods isn't just academic; it has a direct and measurable impact on your true per-unit cost. The choice of a value-based versus a quantity-based allocation can shift unit costs by 1–15% within the exact same shipment. For an Amazon seller or omnichannel brand, this swing has immediate consequences for pricing and profitability.

If your premium product’s true landed cost rises from $12.00 to $13.20 (a 10% increase) because you used the right allocation method, but your pricing was based on the lower figure, your gross margin is already overstated.

The best practice is to choose an allocation method that mirrors commercial reality and stick with it for consistency. For most sellers with a mixed-value inventory, allocation by commercial value is the gold standard for accuracy.

This consistency allows you to perform reliable, apples-to-apples comparisons of SKU profitability over time. It prevents you from making flawed replenishment decisions based on distorted data, ensuring you invest your capital in the products that are truly driving your business forward.

Knowing the formula for landed cost is one thing. Nailing it every single time in the real world? That's a different beast altogether.

Even seasoned importers trip up on little details that quietly bleed their profit margins dry. We're not talking about huge strategic blunders here. Usually, it’s the simple, everyday oversights that compound over time and turn into serious financial headaches.

Let’s get practical and break down the most common mistakes I see sabotage otherwise healthy businesses—and more importantly, how you can sidestep them.

This is easily one of the most damaging—and frequent—errors you can make. Getting your Harmonized System (HS) code wrong triggers a nasty domino effect on your bottom line. That little code is what customs uses to determine your duty rate, and a tiny misclassification can cause that rate to jump dramatically.

Let's say you're importing a new electronic gadget. You classify it under a code with a 3% duty rate. But when it lands, a customs agent decides it actually belongs in a more specific category with a 10% duty. Suddenly, that's a massive, unbudgeted bill you have to pay. And it doesn't stop there. This can lead to your shipment being held up, full-blown audits, and even steep fines for non-compliance.

How to get it right:

Here’s a classic scenario: you place a big purchase order with your supplier, but you don't actually pay the final invoice for another few weeks or months. In that time, the exchange rate can swing—a lot.

A 2-3% shift might not sound like a big deal, but on a $50,000 order, that's a $1,000 to $1,500 loss that comes directly out of your pocket. You’re essentially gambling with your profit margin every time you place an order in a foreign currency without a plan.

The price you agree on today isn't necessarily the price you'll pay tomorrow. Proactively managing your currency exposure is a sign of a smart, financially sound importing operation.

That final invoice from your freight forwarder can be a real shocker. You’ve budgeted for the big stuff like ocean freight, but then you see a long list of smaller charges that add up—fast. I call it "death by a thousand cuts."

These are the fees many sellers completely forget to factor in:

If you leave these out of your landed cost calculation, you create a dangerous gap between your estimate and reality. Errors in estimating these duties and fees are a major source of pain. Misclassification or an incorrect valuation can easily create a 5–25% difference in what you owe.

For example, if you budget 3% duties on a $200,000 shipment ($6,000) but a simple HS code error results in a 6% duty, your actual cost jumps to $12,000. That $6,000 shortfall hits your bottom line directly. To see how automation can help close this gap, you can discover more insights about landed cost calculation on klavena.com.

By getting ahead of these common mistakes, you can build a much more accurate and resilient costing process. This turns your landed cost calculation from a reactive chore into a strategic tool for protecting—and growing—your profits.

Theory is one thing, but running the numbers on an actual shipment is where you really get it. So, let’s walk through a practical, real-world example to see how all these different costs stack up. This is exactly how you’ll want to calculate the landed cost for your own products.

We’ll track a hypothetical shipment for an e-commerce brand importing 5,000 units of a consumer electronic device.

Here are the details:

Everything starts with the supplier's invoice. Since we’re using FOB terms, this price includes not just the product itself, but also the supplier’s cost to get it to the port and loaded onto the boat.

This $50,000 is our baseline. From this point on, every other expense is on our dime.

With the goods on the ship, we now have to get them from Shanghai to Los Angeles. This means booking ocean freight and, critically, getting insurance to protect our investment while it's out on the high seas.

These two items alone tack on another $3,750. It's a big jump, but we’re not done yet. Not even close.

Once the container hits U.S. soil, it has to clear customs. This is where so many sellers get blindsided by unexpected costs. To get an accurate figure, we first need the product's HS code to find the correct duty rate.

For our consumer electronics, the HS code is 8517.12.00, which actually carries a U.S. duty rate of 0%. Sounds great, right? Not so fast. Many electronics from China fall under Section 301 tariffs. Let's assume a 7.5% tariff applies here.

But wait, there’s more. We also have a few other non-negotiable fees:

So, the total bill for customs and associated fees hits $4,335.70.

Getting these fees right is non-negotiable. One small miscalculation in your duties or forgetting about the MPF and HMF can instantly vaporize a huge chunk of your profit margin. Accuracy here is everything.

We're in the home stretch. The final leg of the journey is getting the container from the port to our warehouse. This last-mile delivery, known as drayage, is the last major expense we need to tally up.

Okay, we have all the pieces of the puzzle. Let's lay it all out in a simple table to see the grand total and, more importantly, the true cost per unit.

Here’s the full breakdown, showing how that initial $10 product cost balloons once it lands at your warehouse door.

Cost ItemCalculation/NotesCost (USD)Cost Per UnitProduct Cost5,000 units @ $10.00/unit$50,000.00$10.00Ocean FreightQuote from freight forwarder$3,500.00$0.70Marine Insurance0.5% of commercial value$250.00$0.05Customs Duties7.5% of commercial value$3,750.00$0.75Brokerage & FeesMPF, HMF, and broker fee$585.70$0.12Local TruckingDrayage from port to warehouse$750.00$0.15TOTAL LANDED COSTSum of All Costs$58,835.70$11.77

And there it is. Our $10.00 product actually costs us $11.77 by the time it's in our warehouse, ready to be sold. That's a 17.7% increase over what we paid the supplier. This is the number you have to use for all your pricing and profitability calculations.

Knowing this final per-unit cost is absolutely crucial for setting your sales price. You can plug this number directly into an Amazon FBA profit calculator to see your real margins after platform fees and other selling costs are factored in. Without that $11.77 figure, any profit forecast you make would be dangerously wrong.

Once you’ve wrestled with the core components and run through a few calculations, the practical, day-to-day questions start popping up. Getting the formula right is one thing; applying it consistently as your business grows is a whole other beast.

Let's tackle some of the most common questions I hear from e-commerce sellers.

The short answer? Far more often than you probably think. Your landed cost is not a "set it and forget it" number. It’s a living metric that gets pushed around by all sorts of external factors.

You need to run a full recalculation:

A good rule of thumb is to review your key products’ landed costs every quarter, even if none of those other triggers hit. This proactive check-in prevents those small, unnoticed cost creeps from silently eating away at your profit over time.

Incoterms are the rules of the road for international shipping—they define who pays for what, and they have a massive impact on your landed cost math. While there are a bunch of them, two common ones show the difference perfectly: DDP (Delivered Duty Paid) and DDU (Delivered Duty Unpaid), which is now officially called DAP (Delivered at Place).

With a DDP shipment, your supplier handles everything—shipping, insurance, and all the import duties and taxes. In this scenario, the price they quote you is basically your total landed cost. It's simple and predictable, but you often pay a premium for that convenience and give up control over the entire logistics process.

On the other hand, with a DDU/DAP shipment, the seller just gets the goods to the destination country. After that, you are on the hook for paying all the import duties, taxes, and customs clearance fees. This means you have to calculate and budget for these costs yourself, as they won't be on the supplier's invoice.

Understanding your Incoterms is ground zero for knowing which costs even belong in your calculation. DDP simplifies the math but can hide expensive inefficiencies. DDU gives you more control but demands a much more detailed calculation on your end.

Ah, the classic trade-off between speed and precision.

When you’re setting prices for a brand-new product, you have no choice but to start with estimated costs. You won’t have the final freight bill or the customs invoice yet, so you'll have to rely on quotes and historical data from similar shipments. This is totally normal.

However—and this is a big one—once the shipment has landed and all the invoices are paid, you absolutely must go back and reconcile your estimates with the actual costs. This is a crucial step that too many sellers skip.

Comparing your estimated landed cost to your actual landed cost is the only way to know how accurate your forecasting is. If you find a big gap—say, your actual costs came in 8% higher than your estimate—you need to adjust your retail price for future inventory and dig in to find out where your estimates went wrong.

Flying blind on estimated costs without ever checking them against reality is a recipe for slowly bleeding profit without ever knowing why.

At Million Dollar Sellers, we know that mastering details like landed cost is what separates the good e-commerce businesses from the great ones. Our exclusive community is built for top-tier founders who want to share A-level strategies, solve complex operational challenges, and scale their brands faster.

Discover how the MDS network can help you optimize every part of your business.

Join the Ecom Entrepreneur Community for Vetted 7-9 Figure Ecommerce Founders

Learn MoreYou may also like:

Learn more about our special events!

Check Events