Stay Updated with Everything about MDS

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Chilat Doina

January 2, 2026

The fundamental choice between equity vs. debt financing boils down to a simple trade-off: are you selling a piece of your company for cash, or are you borrowing money that you have to pay back? Your answer to that question will shape everything from your ownership stake to your company's financial obligations down the road.

Figuring out how to fund your e-commerce business is one of those cornerstone moments every founder faces. The path you take—whether you bring on partners or take out a loan—sends ripples through your entire operation, influencing your control, your profits, and your company's long-term health. Let's dig into the two main ways to get it done.

Equity financing is all about selling ownership stakes—or shares—in your company to investors. Think angel investors or venture capitalists. In exchange for their cash, you get capital to grow and, just as importantly, you often get access to their experience and professional network. The upside for you? No monthly loan payments, because your investors are betting on your future success to get their return.

Then there's debt financing. This is the more traditional route where you borrow a lump sum from a lender, like a bank or a private credit fund, and agree to pay it back over time with interest. The huge advantage here is that you keep 100% ownership and control of your business. This is a great fit for businesses that already have a predictable cash flow and can handle the fixed repayment schedule without breaking a sweat.

We've put together a detailed guide covering all the different options for https://milliondollarsellers.com/blog/funding-for-ecommerce-business if you want to explore the specific models that work best for e-commerce.

To cut through the noise, it helps to see a direct, side-by-side comparison. This table lays out the core differences every founder needs to understand.

CharacteristicEquity FinancingDebt FinancingOwnershipYou sell a piece of your company, which dilutes your stake.You keep full ownership and control of your business.RepaymentNo monthly payments; investors cash out when the company grows or sells.You have a fixed repayment schedule with interest, no matter what.CostThe "cost" is giving up a share of your future profits (dilution).The cost is the interest you pay on the amount you borrowed.ControlInvestors might get board seats and a say in major decisions.You run the show. Total operational freedom.

The cost is where founders really need to pay attention. For a young startup, the true cost of equity can be astronomical, sometimes ranging from 30% to 80% of the company’s future value. It can be far more expensive than debt in the long run. In comparison, debt typically costs somewhere between 1% and 20% above the risk-free rate, making it a much cheaper source of capital on paper.

A useful way to think about how these two capital types fit together is the real estate capital stack. While the term comes from property development, the concept of layering different types of financing applies perfectly to how businesses structure their funding.

When you're comparing equity vs. debt financing, the cash that lands in your bank account is just the opening act. The real story unfolds over the long term, and the true cost of that capital goes way beyond the initial number on the check. As a founder, you have to look past the surface to see how each path will really impact your company’s future.

Debt financing can seem simple on the surface, but its cost is always more than just the interest rate. You've got to factor in all the associated expenses that pile up over the life of the loan.

These often include:

Navigating this web of obligations demands sharp financial planning. To get your fundamentals in order, our guide on how to manage cash flow is a great resource for keeping your business healthy while you're servicing debt.

The biggest financial upside to debt financing is how the tax man sees it. The interest you pay on business loans is almost always tax-deductible, which brings down the real cost of borrowing money.

Let’s say your e-commerce business gets a $100,000 loan at 8% interest. If your corporate tax rate is 21%, your annual interest payment comes out to $8,000. But here's the kicker: that payment lowers your taxable income, saving you $1,680 in taxes ($8,000 x 0.21).

This means your effective interest rate isn't actually 8%—it's 6.32%. That tax shield is a serious perk that equity financing just doesn't have.

With equity, the cost isn't paid back in monthly checks; it's paid in dilution. Dilution is simply the shrinking of your ownership percentage when you bring on new investors by issuing new shares. You don't have to make repayments, but you are giving away a piece of your company's future profits forever.

The real cost of equity isn't what you give up today, but what that piece of the pie could be worth down the road. A small slice of a massive success can be worth infinitely more than all the interest you'd ever pay on a loan.

Let's walk through a scenario. You own 100% of your company, currently valued at $1 million. You decide to raise $250,000 by selling equity. Investors are in, but for their cash, they get a 20% stake in the business, which is now valued at $1.25 million (this is the "post-money" valuation).

In an instant, your ownership drops from 100% to 80%. You have the cash to grow, sure, but you've permanently sold off one-fifth of your company. If your business later sells for $10 million, that 20% stake is now worth $2 million—a pretty high price for a $250,000 check.

This potential future value is the true, and often painfully underestimated, cost of equity. Getting your head around this trade-off is at the very heart of the equity vs. debt financing debate.

Beyond the spreadsheets and financial models, the debate over equity financing vs debt financing gets personal for founders. It comes down to one thing: control.

This isn't just about the money. It's about your vision, your autonomy, and your ability to steer the ship you poured everything into building. The path you choose here will fundamentally define your role within your own company for years.

Think of equity financing as a partnership. And every partnership involves compromise. When you sell shares, you aren’t just getting a check; you're bringing on new stakeholders who have a vested interest—and often, a legal right—to influence where your company goes next.

For first-time founders, just how real that influence is can be a shock.

Taking on equity investors means you're no longer the only one making the big calls. This shift can be jarring. Investors need to protect their money and guide the company toward a profitable exit, and they have formal ways of doing just that.

Here are the key areas where you’ll feel the change:

A founder’s passion is to build something lasting. An investor's mandate is to generate a return. These goals can align, but when they don't, the one with the voting rights usually wins.

Imagine you want to reinvest profits into a long-term R&D project you truly believe in. Your investors, however, might see a faster path to returns by cutting those costs and pushing short-term sales. This is a classic friction point where a founder’s control gets put to the test. For startups looking for capital without giving up equity, understanding what non-dilutive funding is can be a complete game-changer.

Debt financing is a completely different world. When you take out a loan, your relationship with the lender is purely transactional. You borrow their money, you pay it back with interest, and the obligation ends there. Simple as that.

This path lets you keep 100% ownership and complete operational autonomy. As long as you make your payments, the lender has zero say in your business strategy.

The trade-off for all this freedom is the financial pressure of those monthly payments. But for founders who value their vision and independence above all else, debt is often the way to go. For those deep in the e-commerce trenches, learning the specifics of raising private capital for your next Amazon business can offer more tailored insights for structuring these kinds of deals.

The whole equity vs. debt debate isn't just about cost or control—it's about timing. Picking the right funding is completely tied to how mature your company is. The kind of capital that launches a pre-seed startup can absolutely cripple a stable, growing business, and the other way around.

When you map your financing strategy to your business stage, you’re just making sure you're using the right fuel for the right part of the journey. Early-stage companies are all over the place, which makes them a terrible fit for fixed debt payments. On the flip side, mature businesses with predictable cash flow can use debt to their advantage without giving up precious equity.

In the very beginning, you're usually selling a vision, not a proven product. Cash flow is shaky at best (or nonexistent), and the risk of failure is through the roof. This is the natural habitat of equity financing.

Angel investors and early-stage VCs write checks knowing these risks are high. They’re betting on a massive future payday to make up for the very real chance the business won’t make it.

Debt is almost always the wrong tool at this point. Forcing a pre-revenue company to make mandatory monthly payments is a recipe for disaster. It shifts the focus from innovating to just trying to stay alive.

Once you’ve found product-market fit and have consistent revenue coming in, the game changes. Your capital needs become much more predictable—you need money for inventory, to scale up marketing, or to open new channels. This is where debt financing starts to look really good.

With a sales history, you can actually forecast your ability to handle a loan. Taking on debt lets you fund specific growth projects without diluting your ownership, which is suddenly a lot more valuable.

A classic mistake is to keep raising equity for predictable operational needs. If you know that every $1 you spend on ads brings in $3 in sales, using debt to fund that spend is way cheaper than giving away a piece of your company forever.

This is also where you can tap into the sheer size of the capital markets. The global fixed income markets, where debt is traded, hit $145.1 trillion, while the global equity market was $126.7 trillion. As SIFMA's research shows, the debt ecosystem is massive, with a huge variety of products for businesses that qualify.

For an established business with strong financials and a solid spot in the market, financing becomes more of a strategic tool for optimization. At this point, you can get the best terms for both equity and debt, so the goal is to build the most efficient capital structure possible.

A mature e-commerce brand might use a mix of financing options:

At this level, it’s less about equity vs. debt as a simple choice and more about blending them intelligently. The focus shifts to lowering your weighted average cost of capital (WACC) and boosting shareholder value. By matching low-risk debt to predictable needs and keeping equity for the big, transformative bets, you can fund your growth in the smartest way possible. This stage-aware approach means you’re always using the sharpest tool for the job.

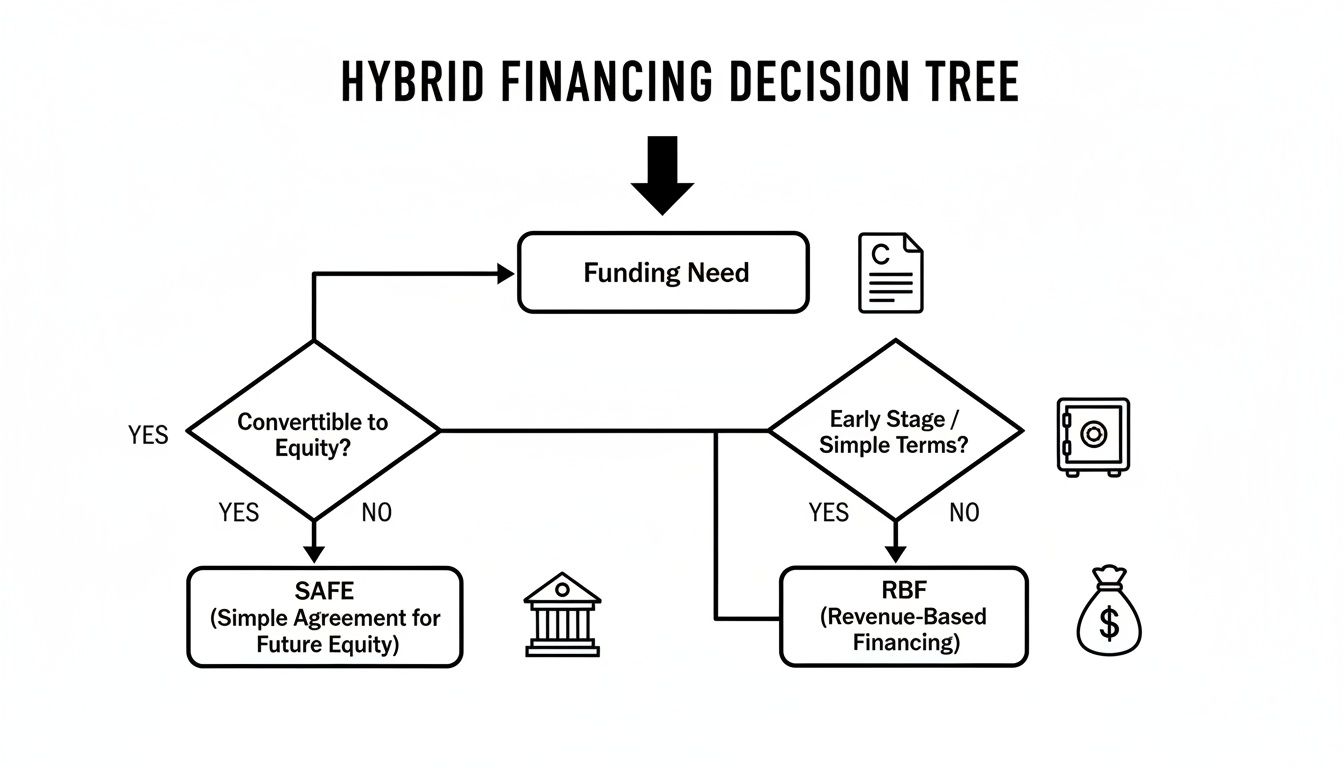

The classic "equity vs. debt" debate often feels like you have to pick one extreme or the other. But the reality of funding is much more nuanced. A whole world of hybrid solutions has emerged, blending the best features of both paths to give founders like you more flexibility and strategic control.

These tools are built for specific situations. They’re perfect for early-stage companies that need cash but aren't ready to lock in a valuation or take on rigid repayment schedules. Getting to know them means you can move beyond a simple "either/or" decision and build a funding plan that actually fits your business.

Convertible notes are one of the most common hybrid tools you'll see, especially for seed-stage companies. It starts out looking like a loan—an investor gives you cash, and you agree to pay it back with interest. The twist? Instead of getting cash back, the "debt" automatically converts into equity during your next official funding round.

This approach has two massive advantages for founders:

The conversion almost always happens at a discount to the share price of the next round. This is how you reward those early investors for taking a bigger risk on you.

Developed by the legendary accelerator Y Combinator, the SAFE (Simple Agreement for Future Equity) has quickly become a go-to alternative to convertible notes. A SAFE isn't debt. There's no interest rate and no maturity date. It's simply a warrant—a promise that gives the investor the right to buy stock in a future equity round.

Just like a convertible note, a SAFE lets you raise capital while pushing the valuation discussion to a later date. The key difference is its radical simplicity and founder-friendly DNA. Since it’s not debt, it doesn't carry the lurking risk of forcing your company into a tough spot if you can't raise another round before a deadline.

A SAFE strips away the debt-like features of a convertible note, making it a cleaner, more straightforward way for early-stage companies to raise their initial capital. It’s pure equity potential without the repayment pressure.

Revenue-Based Financing (RBF) is a game-changer for businesses with predictable cash flow, like most e-commerce stores or SaaS companies. With RBF, an investor gives you a lump sum of capital in exchange for a small percentage of your company's future monthly revenue. You keep paying that percentage until a predetermined total amount is repaid.

This model is nothing like traditional debt. Your repayments aren't fixed; they ebb and flow with your sales.

Most importantly, RBF is 100% non-dilutive. You keep full ownership of your company. It gives you the growth capital you’d get from an equity investment but without sacrificing a single share of control, making it an incredibly powerful choice for founders who want to scale on their own terms.

Okay, this is it. Making the final call between equity and debt financing feels like a huge deal, because it is. You've weighed the costs, the control you'll give up, and what your business needs right now. It's time to take all that information and turn it into a confident, actionable decision.

There’s no magic "right" answer here. There’s only the answer that’s right for your company, at this specific moment. By walking through a few targeted questions, you can build a capital strategy that actually fits your business and what you want as a founder.

Your choice really boils down to four key areas: your company's financial health, how fast you want to grow, your own comfort with risk, and your long-term vision. Let's dig into the critical questions for each.

1. Cash Flow and Predictability

This is the first and most important test. Can your business reliably generate enough cash to pay its bills?

2. Growth Ambition and Capital Needs

What are you actually going to do with the money? The answer is a massive clue about which funding type makes sense.

The smartest founders I know match the risk of the capital to the risk of its use. Don’t use expensive, dilutive equity for low-risk, predictable needs. And please, don’t saddle your company with restrictive debt to fund a moonshot.

Now for the personal side. How you feel about ownership and control is just as valid as any spreadsheet model.

This decision tree shows how some of the newer, hybrid options can give you a middle ground, blending features from both worlds.

As you can see, instruments like Convertible Notes, SAFEs, and Revenue-Based Financing (RBF) offer creative paths to capital that don't force you into a simple "equity or debt" corner right away.

To help pull all this together, use this checklist. It’s a simple way to map your answers to the most logical financing path.

QuestionConsiderations for EquityConsiderations for DebtHow predictable is your revenue?Better for unpredictable or "lumpy" revenue streams.Ideal for businesses with stable, recurring revenue.What will you use the funds for?High-risk, high-growth initiatives (R&D, new markets).Predictable expenses with a clear ROI (inventory, marketing).How much control do you want to keep?You will give up a board seat and some decision-making power.You maintain full control as long as you make payments.What is your growth potential?Best for ventures with potential for 10x+ returns.Suited for steady, profitable growth, not hyper-growth.Can you get a personal guarantee?Not required; investors share the business risk.Often required, putting your personal assets on the line.How important are tax deductions?No tax advantages; dividends are not deductible.Interest payments are typically tax-deductible.What stage is your business?Pre-revenue, early-stage, or scaling for massive growth.Mature, profitable, or with a clear path to profitability.

By walking through these questions, you’re not just picking a funding source. You’re building a clear scorecard that forces you to be honest about your business and your goals. This process ensures your decision is a deliberate, strategic choice that sets your company up for its next chapter.

Navigating the choice between equity and debt financing is one of the most critical junctures for any founder. Let's tackle a few of the questions that come up time and time again.

Hands down, it's getting fixated on the headline number—the amount of capital raised—without truly understanding the long-term cost and what they're giving up in control. So many founders jump straight to equity without even looking at smart, non-dilutive debt options, needlessly signing away huge chunks of their company.

On the flip side, some get starry-eyed about "no dilution" and take on debt their cash flow can't possibly support, which puts the whole business on the line. The key isn't just to get a check; it's to match the financing vehicle to your company's actual stage and needs.

Absolutely. In fact, the most sophisticated founders often do. This strategy is called 'capital structuring,' and it's about being surgical with your financing. You might raise an equity round to fund something big and risky like long-term R&D, while using a debt facility—like a line of credit or revenue-based financing—for predictable, short-term needs like buying inventory.

This lets you perfectly match the type of capital to its use. You can keep your cost of capital low and maintain founder control by using cheaper debt for the day-to-day stuff, saving your precious equity for the big swings that promise huge rewards.

Strategic capital structuring isn't about choosing equity or debt; it's about choosing the right tool for the right job at the right time. Blending both can give you a powerful competitive advantage.

For an early-stage business, it matters a lot. Lenders often have very little business history to go on, so they lean heavily on your personal credit history. They'll frequently require a personal guarantee, which means if the business can't pay, you're on the hook personally.

A strong credit score not only improves your chances of getting approved but can also unlock much better interest rates. The good news is that as your business grows and builds its own track record of steady revenue and credit history, the lender's reliance on your personal credit fades. Eventually, the company can stand on its own two financial feet.

At Million Dollar Sellers, we know that the right capital strategy is the bedrock of any e-commerce empire. Our exclusive community of 7-, 8-, and 9-figure founders is constantly sharing real-world playbooks on smart financing, helping members make the kind of decisions that protect equity and pour fuel on growth. Learn more about joining the top tier of e-commerce entrepreneurs.

Join the Ecom Entrepreneur Community for Vetted 7-9 Figure Ecommerce Founders

Learn MoreYou may also like:

Learn more about our special events!

Check Events